Foundation & Endowment Investment Management in Brecksville, OH

Foundations and endowments in Brecksville, Ohio require sophisticated investment strategies that balance growth objectives with long-term sustainability. Return on Life Wealth Partners provides comprehensive foundation & endowment investment management services designed to help nonprofit organizations, educational institutions, and charitable foundations achieve their mission-driven goals while preserving capital for future generations.

How Professional Investment Management Supports Your Foundation's Mission

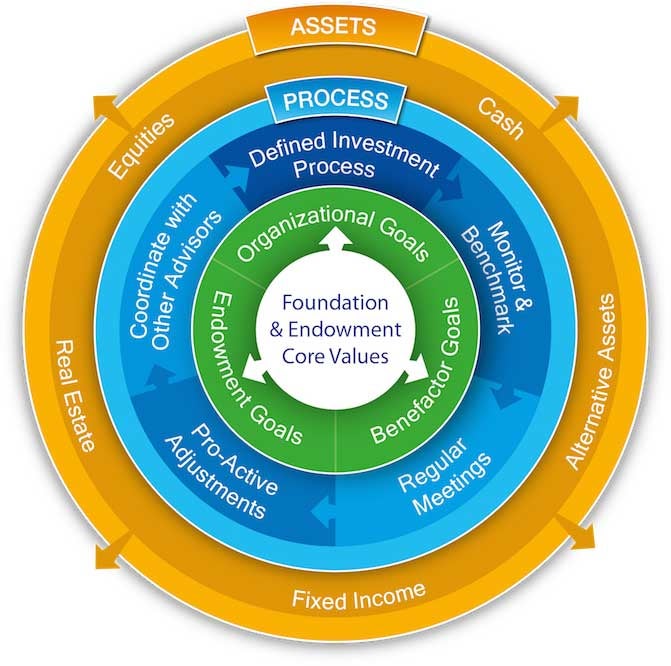

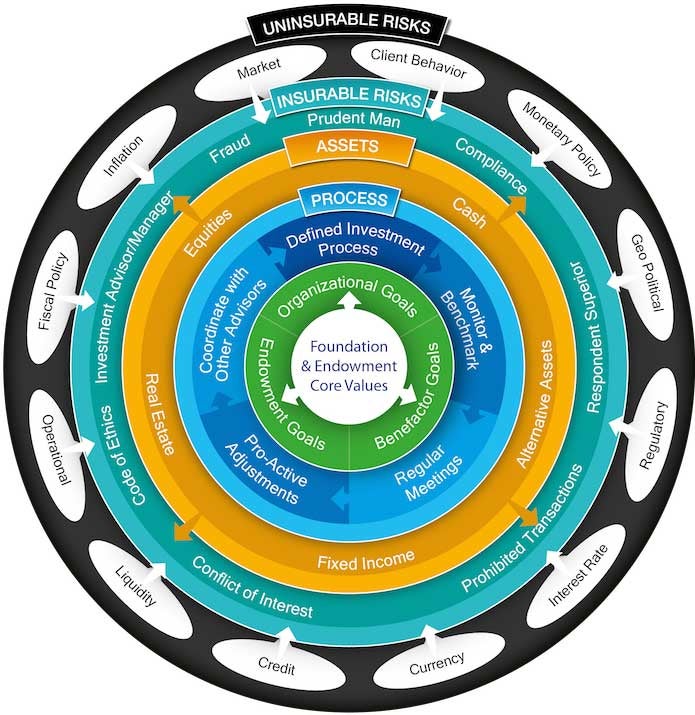

Strategic Asset Allocation for Long-Term Growth

Effective endowment management services begin with developing a strategic asset allocation framework tailored to your organization's specific needs, risk tolerance, and spending requirements. Our team works closely with foundation boards and trustees to create diversified portfolios that can weather market volatility while generating consistent returns to support your charitable activities.

Institutional-Grade Investment Solutions

As your foundation investment advisory partner, we provide access to institutional-quality investment vehicles typically reserved for large endowments. This includes alternative investments, private equity opportunities, and specialized fixed-income strategies that can enhance portfolio diversification and potentially improve long-term returns for foundations of all sizes in the greater Cleveland area.

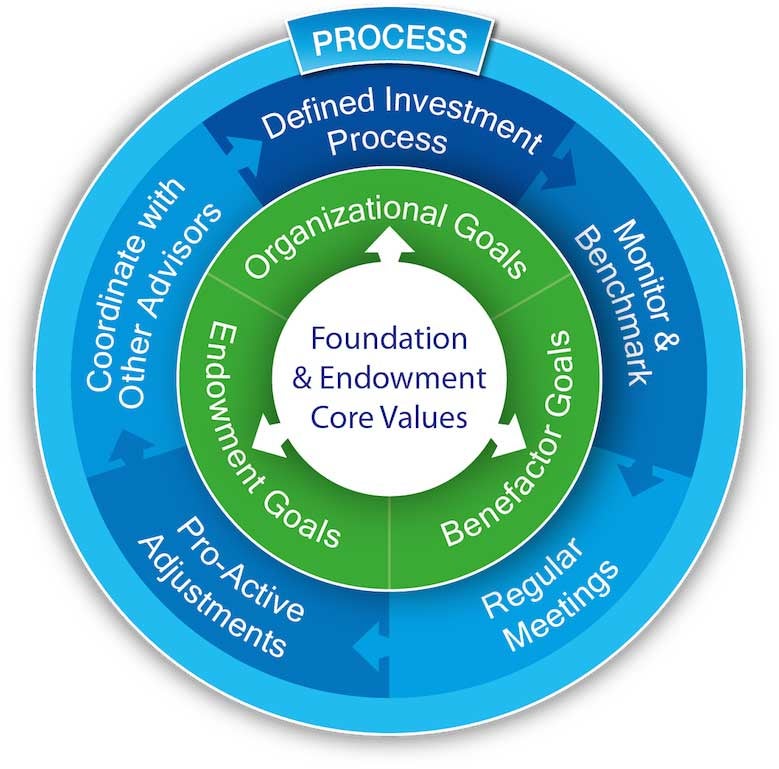

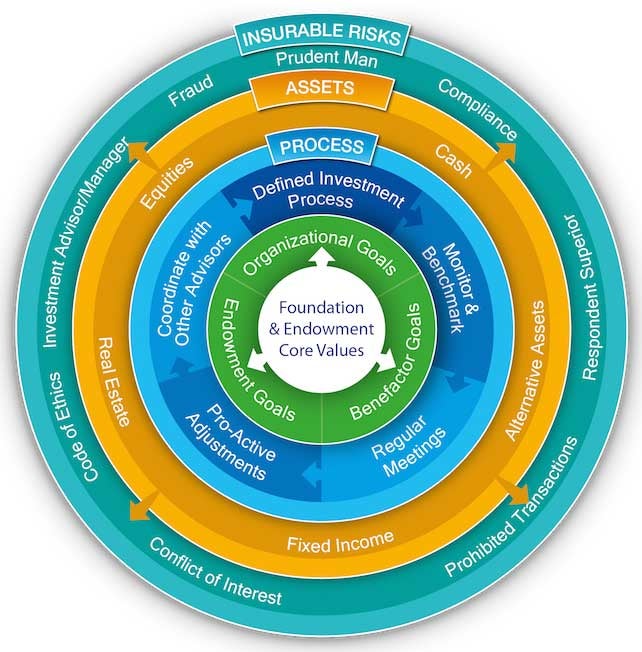

Fiduciary Responsibility and Governance Support

Our institutional investment advisory for foundations services extend beyond portfolio management to include governance support and fiduciary guidance. We help foundation boards establish investment policies, conduct regular performance reviews, and ensure compliance with applicable regulations while maintaining focus on your organization's charitable mission.

Customized Solutions for Brecksville Area Foundations

Understanding Local Nonprofit Landscape

Serving foundations throughout Cuyahoga County, we understand the unique challenges facing nonprofit organizations in the Brecksville community. Whether your foundation supports local education initiatives at Brecksville-Broadview Heights schools, environmental conservation efforts in the Cleveland Metroparks, or community development projects throughout Northeast Ohio, we tailor our investment approach to align with your values and objectives.

Spending Policy Development

We assist foundations in developing sustainable spending policies that balance current charitable needs with long-term capital preservation. Our analysis considers factors such as inflation, market conditions, and your foundation's specific grant-making requirements to establish spending rates that support your mission while protecting the endowment's purchasing power over time.

Impact Measurement and Reporting

Beyond traditional investment reporting, we provide comprehensive performance analysis that helps foundation boards understand how their investment strategy supports their charitable mission. Regular reporting includes portfolio performance, asset allocation updates, and progress toward long-term financial goals.

Proven Investment Strategies for Endowment Success

Multi-Asset Class Diversification

Our investment approach incorporates multiple asset classes including domestic and international equities, fixed income, real estate investment trusts, and alternative investments. This diversification helps reduce portfolio volatility while positioning foundations to capture growth opportunities across different market environments.

Risk Management Framework

We implement comprehensive risk management strategies that include regular portfolio rebalancing, stress testing, and scenario analysis. This proactive approach helps protect foundation assets during market downturns while maintaining the flexibility to capitalize on opportunities as they arise.

Cost-Effective Implementation

Understanding that investment costs directly impact the resources available for charitable activities, we focus on cost-effective implementation strategies. This includes utilizing low-cost index funds where appropriate, negotiating favorable fee structures, and eliminating unnecessary layers of fees that can erode long-term returns.

Working with Northeast Ohio's Leading Wealth Management Firm

Local Presence, National Resources

Located in Brecksville, Return on Life Wealth Partners combines local market knowledge with access to institutional-quality investment resources. Our team understands the specific needs of foundations operating in Northeast Ohio while providing access to global investment opportunities and best practices from leading endowments nationwide.

Collaborative Partnership Approach

We believe successful endowment management requires close collaboration between investment advisors and foundation leadership. Our team works as an extension of your organization, providing ongoing education, strategic guidance, and transparent communication to support informed decision-making by your board of trustees.

Commitment to Fiduciary Standards

As a registered investment advisor, we operate under the highest fiduciary standards, ensuring that all investment recommendations are made in your foundation's best interest. This commitment to fiduciary responsibility provides peace of mind for foundation boards and helps ensure that investment decisions align with your organization's mission and values.

Frequently Asked Questions

What is the minimum asset size for foundation investment management services?

We work with foundations of various sizes, from newly established charitable organizations to well-established endowments with substantial assets. Our scalable approach allows us to provide institutional-quality services regardless of your foundation's current size.

How often should our foundation review its investment policy?

We recommend reviewing investment policies annually or whenever there are significant changes in your foundation's mission, spending requirements, or market conditions. Regular reviews ensure your investment strategy remains aligned with your charitable objectives.

What role should our board play in investment decisions?

Foundation boards should establish investment policies, approve strategic asset allocation, and monitor performance, while delegating day-to-day investment management to qualified professionals. We provide education and support to help boards fulfill their fiduciary responsibilities effectively.

How do you measure success for foundation investments?

Success is measured not only by investment returns but also by how well the portfolio supports your foundation's charitable mission. We track performance against appropriate benchmarks while ensuring the endowment can sustain your desired level of grant-making over time.

Can you help with socially responsible investing strategies?

Yes, we can incorporate environmental, social, and governance (ESG) factors into your investment strategy while maintaining focus on long-term returns. Many foundations find that aligning investments with their values enhances their overall mission impact.

Schedule Your Foundation Investment Consultation

Effective endowment management requires careful planning, disciplined implementation, and ongoing oversight. Return on Life Wealth Partners has the experience and resources to help your foundation achieve its long-term financial objectives while supporting your charitable mission. Our team understands the unique challenges facing foundations in Brecksville and throughout Northeast Ohio.

See How Your Financial Plan Measures Up – Book a Consultation with our foundation investment management team today. Contact us at 440.740.0130 or visit our contact page to schedule a comprehensive review of your foundation's investment strategy and discover how professional endowment management can enhance your organization's ability to create lasting positive impact in the Brecksville community and beyond.

Media Mentions for Return on Life Wealth Partners

Return on Life Wealth Partners and its professionals have been quoted or featured in independent media outlets including [Fox News, The Wall Street Journal, USA Today, etc.]. These references are for informational purposes only and do not represent endorsements by these organizations.